Musk bought Twitter for $44 billion: more than a month's work at every step, and his wish finally came true

This article is authorized to be reproduced from Sixingren (ID: guixingren123)

Original Author: Spectrum Doutzen

Original editor: Vicky Xiao

After a long two weeks, Musk's acquisition of the US social media giant Twitter has finally been settled.

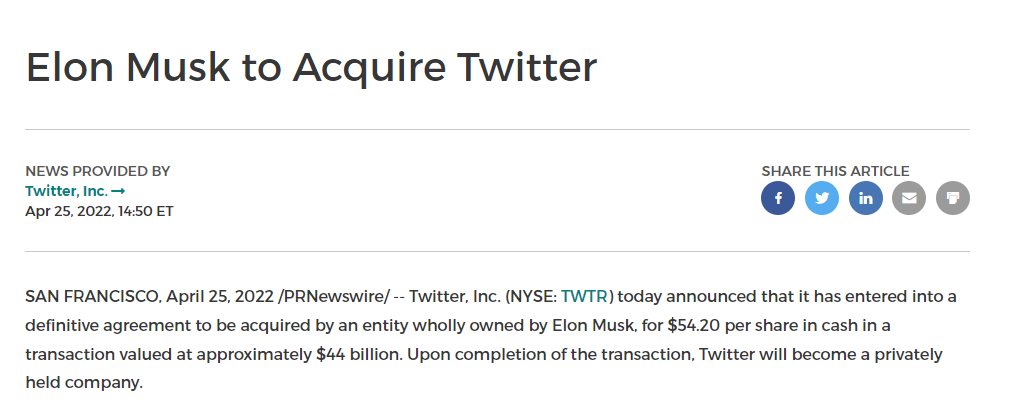

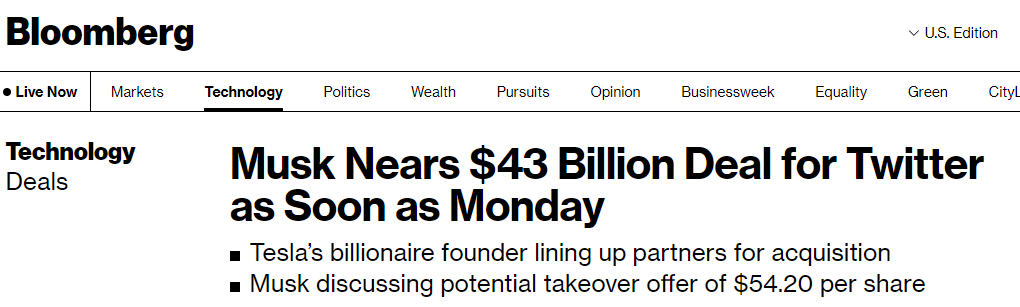

Twitter issued an official news that the board of directors had unanimously approved and accepted Musk's acquisition and privatization offer. The company will be fully sold to technology tycoon Musk at a price of US$54.2 per share, or a total transaction size of approximately US$44 billion.

image description

Screenshot Source: PR Newswire

According to the agreement between Musk and Twitter's board of directors, when the transaction is completed, Twitter shareholders will receive $54.2 per outstanding share in cash. Compared with when Musk suddenly disclosed that he held 9% of Twitter shares at the beginning of the month, the premium rate of this acquisition offer is about 38%.

After the official announcement of the acquisition, Twitter’s stock price rose slightly to close to $52, and closed at $51.70 on the day, an increase of 5.66%. Although there is still a distance from Musk’s offer, it has at least swept away the haze of the past two weeks to a certain extent.

Since Musk suddenly launched a hostile takeover of Twitter two weeks ago, the company's stock price has not risen to a level close to his offer, which means that shareholders have generally not been optimistic about the transaction in the past two weeks.

According to the analysis, Twitter’s board of directors was not optimistic about Musk’s unreasonable acquisition offer at first. The main reason was that he was worried that he did not get enough money to complete the acquisition as he announced in 2018 that he would privatize Tesla.

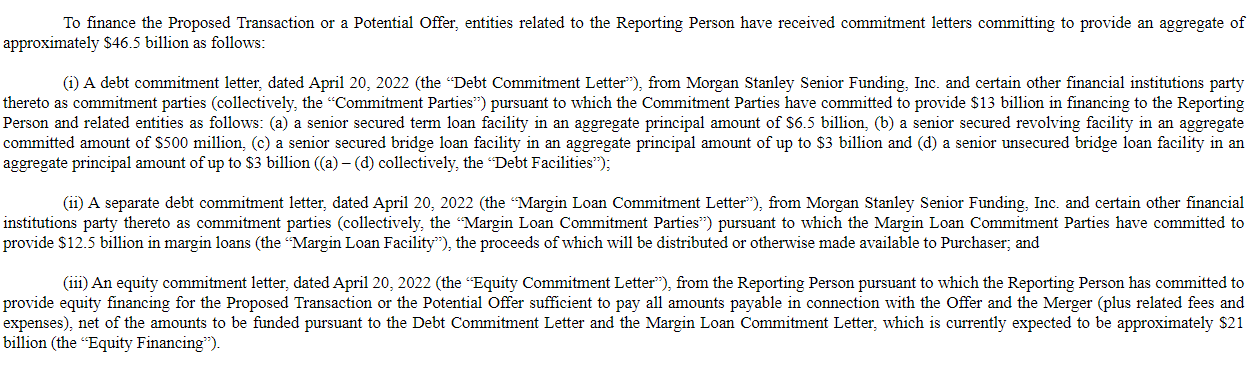

However, according to a document submitted by Musk to the US Securities and Exchange Commission (SEC) last week, he has locked up enough funds to complete the acquisition.

Specifically, Musk obtained a total of US$25.5 billion in loan commitments from Morgan Stanley Senior Funding and other financial institutions under Morgan Stanley, including ordinary, revolving, bridge, and margin loans, and he also promised to invest US$22 billion in financing. in acquisition transactions.

After the acquisition is completed, Musk will carry out drastic reforms to Twitter. It is worth noting that one of the reforms is to conduct some kind of real-name authentication for users.

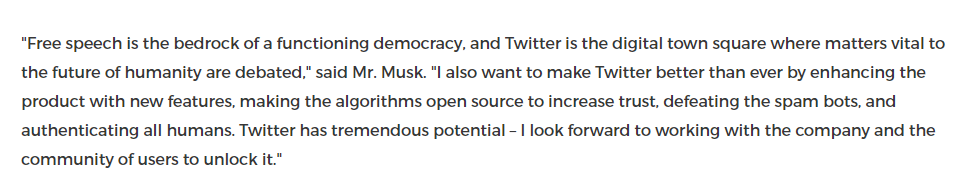

"Twitter has become an online version of the civic square, where many discussions on topics that are particularly critical to the future of mankind take place," Musk said, "I hope to enhance this product with new features; make Twitter's algorithm open source to improve Trust; defeat spam bots on the platform, and authenticate all human users. (authenticating all humans)”

Musk did not specifically explain how this real-name authentication will be carried out.

secondary title

For a month, Musk took every step to "take over" Twitter

On March 14, 2022, low-key increase in holdings:

Musk began to increase his holdings of Twitter stock in a low-key manner and submitted relevant documents to the SEC. He plans to acquire a 9.2 percent stake in Twitter as a passive investment, the documents show. During the half month between that time and the beginning of April, he did not publicly disclose his intention to hold shares, nor did he inform the Twitter board of directors of his actions. The public doesn't know about it either.

However, according to the definition of "passive investment", it means that you are optimistic about this company, and you don't mean to control or even take over Twitter, but just plan to manage your money by holding its stocks.

From the end of March to the beginning of April, there was a big public opinion war:

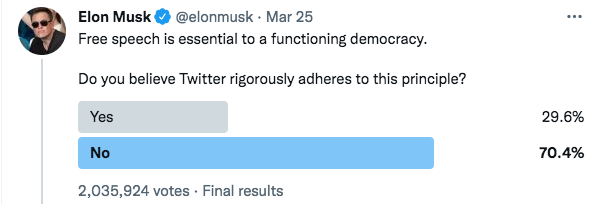

During this time, he has been expressing various opinions about the company on his Twitter account. For example, on March 25, he posted a poll asking fans whether they think Twitter abides by the "Free Speech" principle, As a result, more than 2 million users participated in the voting, and 70% of them believed that Twitter was unqualified on this point.

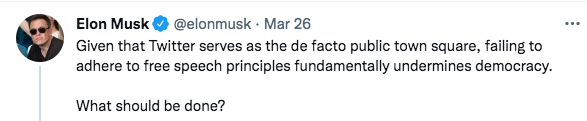

On March 26, he asked after the voting: Since Twitter is doing so badly, what should we do?

On April 4th, start entering the game:

Before the market opened, Musk suddenly announced that he had acquired a 9.2% stake in Twitter at a price of US$2.89 billion. This shareholding ratio exceeded the shareholding ratio of all individual and institutional shareholders at the time, making Musk suddenly became Twitter’s CEO overnight. major shareholder.

As soon as the news came out, Twitter’s stock price began to skyrocket before the market, and lasted for a whole trading day. After the market, the price once reached $50.22 a share, an increase of 27%, creating a single-day increase in Twitter’s stock price since 2018. record. The stock price rise also added nearly $800 million to the value of Musk's own Twitter shares.

However, Musk's delayed disclosure may be suspected of breaking the law. The relevant laws of the US securities exchange stipulate that when the shareholders of a listed company increase their holdings by more than 5%, they should be publicly disclosed as soon as possible or within 10 days at the latest, but Musk delayed for a full half a month.

From April 5th to April 9th, decline the seat on the board of directors:

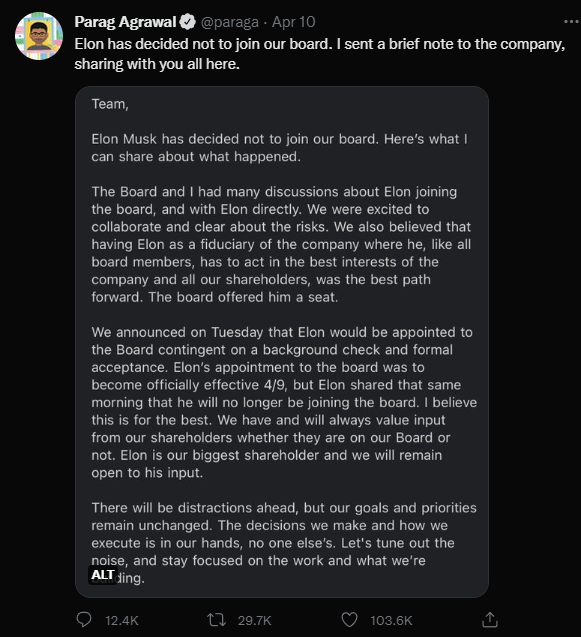

Parag Agrawal, the current CEO of Twitter, congratulated Musk on joining the company through his personal account and invited him to join the board of directors: "I am very excited to share with you that we will appoint Musk to the board of directors! Through conversations with him in recent weeks, we believe more and more , he will bring tremendous value to the board."

However, at the time, some people pointed out a key issue: If it was true as Musk called "passive investment", joining the board of directors had exceeded the definition of passive investment. This is why many observers believe that Musk used the name of "passive investment" before, just to avoid his shareholding plan and subsequent "conspiracy" from being detected by Twitter's board of directors in advance.

Subsequently, Twitter suddenly issued an announcement announcing that Musk did not want to be a director. CEO Agrawal said that Musk's appointment as a director would have come into effect on the same day, but the board received a message from Musk stating that he would not join the board. "I believe this is the best outcome," Agrawal wrote.

From April 4th to April 9th, conduct a test:

In the week following the announcement of the initial shareholding, Musk continued to post opinions and discussions around Twitter on his personal account, many of which were confusing. Surprisingly, he quickly deleted the content. Some anecdotal rumors suggest that Musk should have received a gag order from Twitter's board of directors.

Although he deleted the content he posted, Musk liked many tweets in those days, which seemed to imply that he was sincere for the good of Twitter, and was regarded as a wolf by the board of directors.

Two days later, Musk's lawyer updated the SEC with the shareholding documents. This time the document added a very far-reaching sentence: "In addition to the previous arrangements, the declarer will reserve the right to modify the shareholding plan at any time."

In today's context, this sentence means that Musk may continue to increase his holdings in the future. Sure enough, two days later, Musk launched a general attack on Twitter.

On April 13, a general offensive was launched:

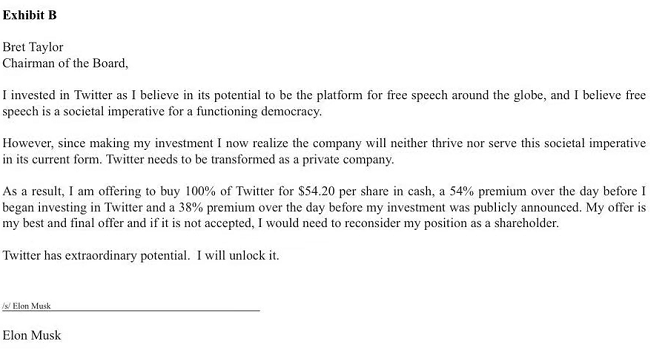

Musk sent Twitter's board of directors a wholly-owned acquisition and a private offer. He said he would pay $54.20 per share for all Twitter shares he didn't already own and take the company private.

In and Twitter chairman(also Salesforce CEO)In a call from Bret Taylor, Musk issued his "ultimatum": 1) The price is right, and shareholders will be satisfied; 2) There is no confidence in Twitter's current management; 3) This time it is a serious acquisition, I don't want to fight Tai Chi with the board of directors; 4) I have no other options, so I finally decide to buy; 5) If I invest in a company, I must see that the company develops well. The identity of the company cannot be realized, so I must fully take over and privatize and delist.

On April 14, resistance was encountered:

The news that Musk intends to acquire a wholly-owned subsidiary was officially exposed. Some major shareholders have started their own "anti-horse" actions, including but not limited to: the previous largest shareholder Vanguard increased its shareholding to 10.3%, surpassing Musk; Saudi Prince Alwaleed bin Talal stated that Musk's acquisition offer Not in line with the intrinsic value of Twitter, the Saudi royal family holding company will directly reject the acquisition offer; several other shareholders have jointly launched a lawsuit against Musk, accusing him of delaying disclosure in violation of the law and causing losses to shareholders.

On the same day, Musk attended the TED conference held in Vancouver, Canada, and directly shouted to investors: I want to retain investors, but if I don’t buy it, I can buy out their shares, “I don’t like failure.”

On April 15, the poison pill program:

image description

The picture comes from the Internet, and the copyright belongs to the original author

Although it sounds a bit scary, in fact, the launch of the poison pill plan does not really have to be implemented. It is actually to buy time for further negotiations, which is equivalent to other Twitter shareholders using poison pills as a threat to either continue to raise prices or give If you come up with a satisfactory acquisition plan, if you are not satisfied, you can only destroy it together.

In fact, Twitter did not really continue to implement the poison pill plan, but continued to negotiate with Musk.

From April 18th to 21st, get the funds:

Musk's acquisition has been questioned by the entire industry. Some people think that he may not get enough money to complete the transaction, as he did when he took Tesla private (failed).

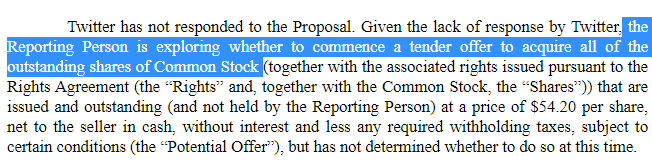

Musk submitted a document stating that since Twitter's board of directors did not respond to his acquisition request, he did not rule out the possibility of using a "tender offer" (tender offer), that is, no longer approved by Twitter's board of directors. It is to directly acquire some or even all of the shares from other shareholders to complete the transaction.

In the document, Musk also responded to rumors that he had no money to buy Twitter, stating that he had received more than $25 billion in debt financing/loan commitments from financial institutions including Morgan Stanley. , and will also contribute 21 billion US dollars.

secondary title

Why did Musk buy Twitter?

An article in The New Yorker magazine pointed out that, judging from the current situation, Twitter is undoubtedly a "dysfunctional" company.

Twitter's product progress can't keep up with other competitors (such as Facebook, TikTok); feature updates are extremely unstable, and it has been refusing to provide users with the features they want, resulting in poor user reputation; the advertising-based business model has never changed; Mainstream speech (such as the views of ultra-conservatives) is too strictly blocked and so on.

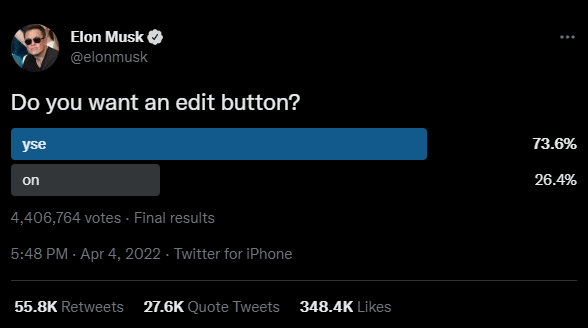

Musk has previously "spoiled" what changes he would bring if he took charge of Twitter in the future: adding a button to edit tweets would be one of the most immediate and popular changes.

Musk himself has tasted the bitter fruit of indiscriminate tweeting.

In 2018, he sent hundreds of tweets related to the privatization of Tesla, which had a considerable negative impact on the company's stock price and shareholders' equity, prompting the SEC to initiate a lawsuit against him. Later, Musk had to accept that Tesla’s board of directors would review his company-related tweets before reaching a settlement with the SEC and paying a large amount of settlement money.

As Musk said in the acquisition statement, the most important purpose of this acquisition of Twitter is to completely revise and rewrite the platform's rules and regulations for speech management and the consequences of posting speech. He has expressed his desire to protect "free speech" on this platform many times recently in various channels.

In the statement, he also said that he would be making the following changes to Twitter products and the company as a whole:

1) Enhance the product with new features: edit button, better short video/live broadcast, and audio live broadcast functions are all possible considerations;

2) Open source algorithms to enhance public trust: He just said this a few times, without specifically explaining what algorithms are open source, and what open source methods are. However, based on public information and reasonable guesses, what he meant was to disclose the algorithm for displaying Twitter timeline information, that is, to let the public understand why they see what content on the timeline, and it may even be possible for users to Define the working method of this algorithm by yourself, so that the timeline can better meet your needs;

3) Defeating spam bots: In general, eliminating the existence of bot accounts/ trolls and making the platform cleaner should be the desired result of all users.

4) Authenticating all human users (authenticating all humans): It is not yet sure what the specific authentication method is. We can only continue to see Musk's follow-up actions.

And, finally, regarding the protection of speech, Musk tweeted this today:

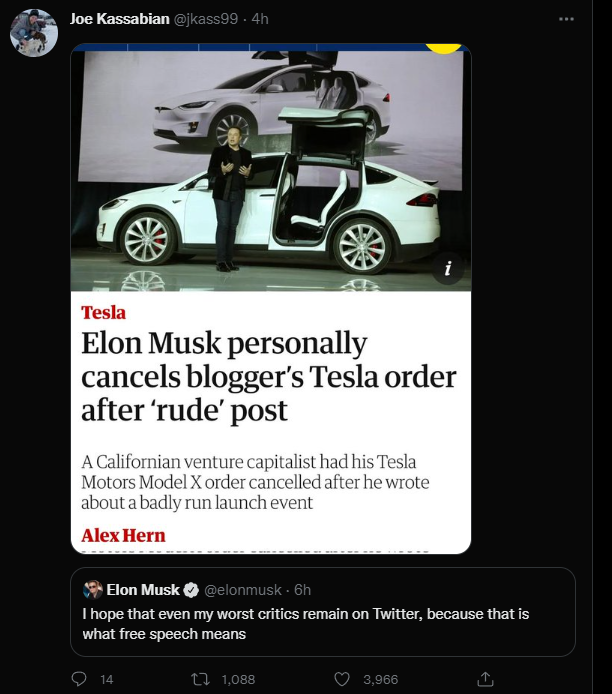

"I hope even my most hated critics can stay on Twitter because that's what free speech is really about."

But someone immediately pointed out his hypocrisy:

Caption: Because a venture capitalist criticized the Tesla conference experience for being extremely poor. Musk personally canceled his Tesla car order.

The original picture of the title picture comes from the drama "Mind Reader" of Hong Kong Television Broadcasting Co., Ltd., and the copyright belongs to the original author. If you do not agree to the adaptation, please contact us as soon as possible, and we will delete it immediately.

The content has been exclusively authorized. If you need to reprint, please contact Silicon Star (ID: guixingren123).