02

-03

Must Read

ALL

H o t P i c k s

PayFi王炸来袭,XPL上线在即,Plasma One的基因重要吗?

VC融资2400万美元,锁定TVL 20亿美元,Plasma One或成“收益最香稳定币理财产品”。

2025-09-23 19:17

public chain

blockchain

stable currency

DeFi

USDT

FTX

founder

H o t P i c k s

增发10亿UXLINK的黑客,刚被钓鱼团伙顺走5亿枚

预定黑吃黑名场面;攻击者和空军这是把项目往死里打啊……

2025-09-23 16:43

wallet

exchange

Safety

币股周报丨Bitmine上周增持1.5万余枚ETH;Sharplink回购100万股SBET(9月23日)

加密概念股涨幅前三分别为BITF、FIGR、CLSK。

2025-09-23 12:00

ETH

SEC

Solana

Galaxy Digital

M a r k e t V i e w

一小时爆仓10亿美元,2位逃顶大师操作被称“内幕级”

整体宏观环境与资金流动层面,并未显现出实质性利空,不过以太坊的百亿美元潜在抛压仍是隐忧。

2025-09-22 16:55

ETH

E d i t o r ’ s C h o i c e

狂涨6000%后,永续合约DEX赛道的“下个Aster”在哪?

热门新市场不会只有一两个赢家。

2025-09-21 15:11

DEX

airdrop

Top-tier Trading Bot Polycule on Polymarket Hacked, How Should Prediction Market Projects Strengthen Security Measures?

On January 13, 2026, Polycule officially confirmed that its Telegram trading bot was hacked, resulting in approximately $230,000 in user assets being compromised. With the bot going offline and compensation promises being announced, the incident quickly sparked industry-wide discussions on the security of Telegram Trading Bots. Examining Polycule's functional structure and design logic reveals that this was not an isolated failure, but rather the concentrated eruption of long-standing yet underestimated security risks inherent in the trading bot model.

2026-01-14 17:33

Safety

Aster's "Human vs AI" Season 1 Live Trading Competition Concludes

The next trading showdown will commence on January 22nd.

2026-01-14 17:19

AI

Test 111

Test 111

2026-01-10 17:56

Project Activities

Trump

Binance Alpha Second Wave Quack AI (Q) Airdrop Threshold is 240 Alpha Points

Odaily News Binance announced the launch of the second wave Alpha Quack AI (Q) airdrop. Users holding at least 240 Binance Alpha points are eligible to claim the token airdrop. Claim 2,500 Q tokens on the Alpha campaign page. If the rewards are not fully distributed, the point threshold will automatically decrease by 5 points every 5 minutes. Please note that claiming the airdrop will consume 15 Binance Alpha points. Users must confirm their claim on the Alpha campaign page within 24 hours, otherwise, it will be considered as forfeiting the airdrop.

2025-12-31 17:05

Gate Founder Dr. Han's 2025 Year-End Open Letter: Web3 is About to Change Everyone's Life

The market is evolving, technology is accelerating, and new cycles and new applications are constantly emerging.

2025-12-31 15:59

Safety

blockchain

technology

Can Infrared Finance Unleash the Full Potential of Liquid Staking on Berachain?

This article provides a comprehensive exploration of the Infrared Finance ecosystem. We will examine its core components, dual-token model, strategic position within Berachain, and its potential to become a foundational liquidity hub for this rapidly growing network.

2025-12-31 15:32

smart contract

invest

DeFi

DAO

OKX Star's Year-End Letter to Global Users: Steady Progress Towards Financial Freedom

“Financial freedom” is often misunderstood. It does not mean the absence of rules, but rather the right to choose within the framework of existing rules.

2025-12-31 15:30

Safety

finance

OKX

Arkstream Capital: In 2025, When Crypto Assets Return to "Financial Logic"

Looking ahead to 2026, the industry's growth trajectory is more likely to depend on three variables: whether the institutionalization pathway can continue, whether capital accumulation is sustainable, and the resilience of leverage and risk control under stress scenarios.

2025-12-31 15:28

stable currency

invest

Prediction Market

I Made Millions from $50 at Age 18 by Tracking Wallets

The ignition for any market rally doesn't originate on social platforms, but within a small fraction of wallets.

2025-12-31 15:27

wallet

What are the characteristics and commonalities of tokens that have performed decently after their TGE in 2025?

The market no longer rewards token "potential," but instead rewards project "structure."

2025-12-31 15:26

exchange

Binance

AI

Fed Meeting Minutes: "Most" Officials Expect Further Rate Cuts Appropriate After December, Some Advocate Holding Steady for "Some Time"

Most participants supported a rate cut in December, with a few believing the decision was carefully weighed and they might have otherwise supported holding steady. Those supporting the cut generally cited increased downside risks to employment in recent months.

2025-12-31 15:23

policy

currency

Why Is Your Crypto Product Unused? The Answer After 500 Pitfalls

Speed, users, and distribution are often more important than "technology that looks impressive."

2025-12-31 15:21

Developer

invest

founder

technology

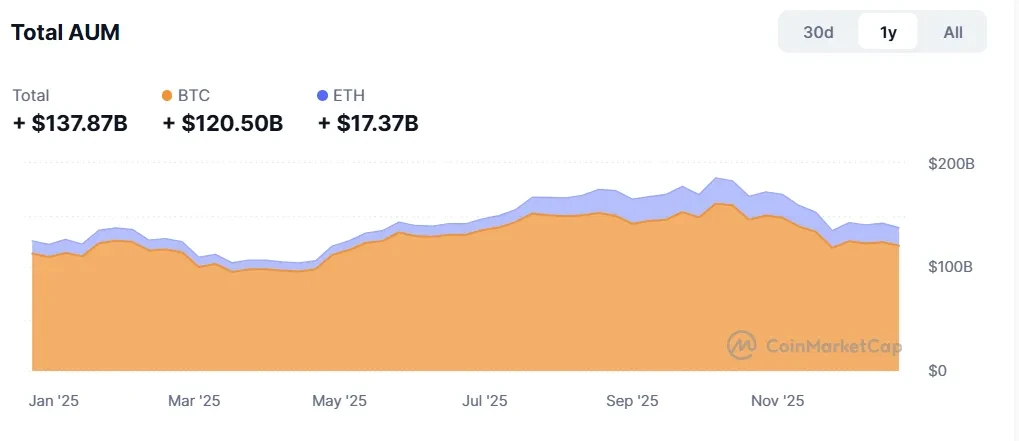

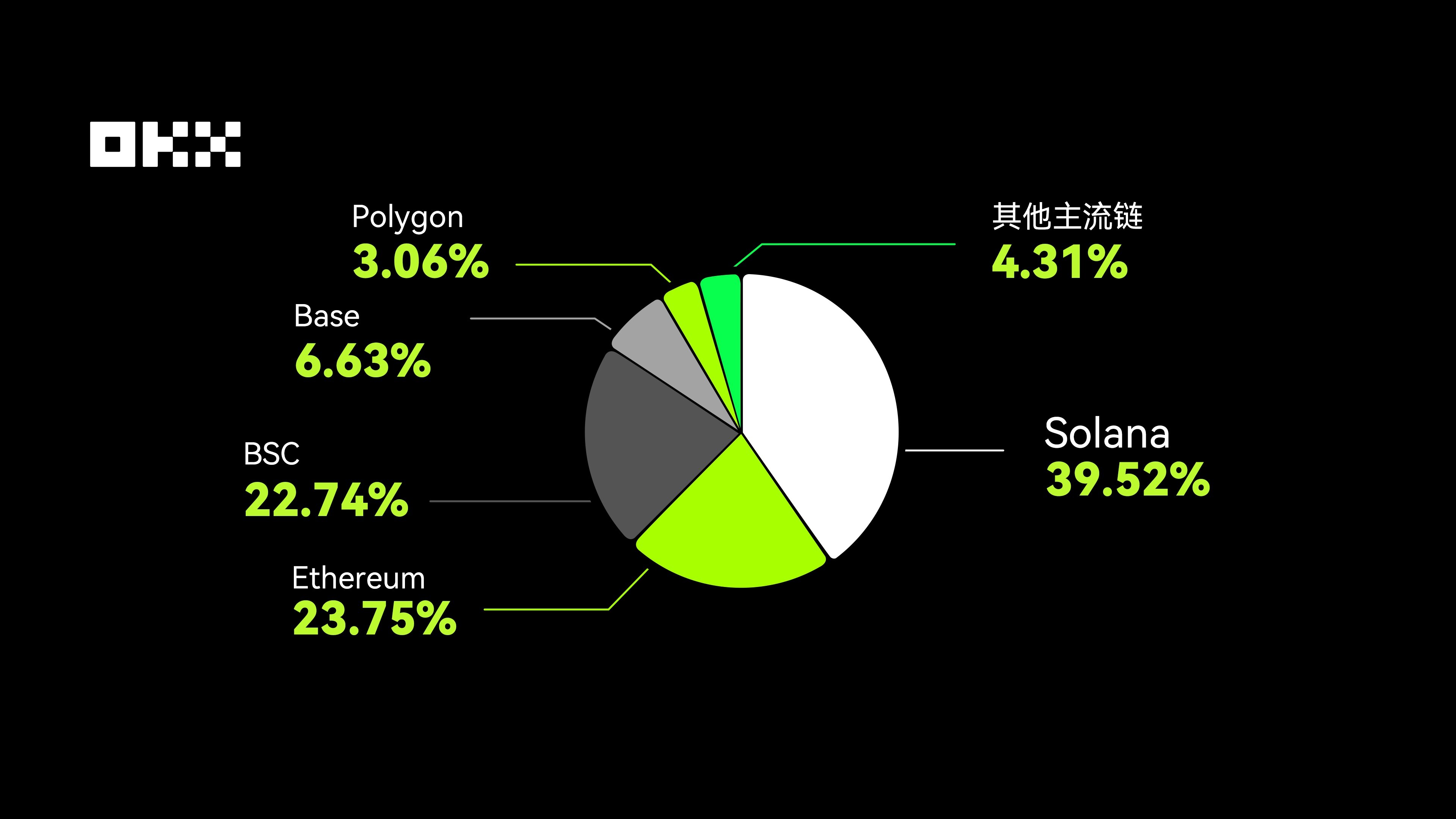

A Review of 2025 Web3 Narratives Through Real On-Chain Data | OKX Annual Report

While everyone is chasing narratives, users have already written the annual truth with their own actions.

2025-12-31 15:12

wallet

public chain

DeFi

Cross-chain

DEX

Bitcoin Officially Enters Bear Market: On-Chain Evidence, Capital Flows, and How Investors Can Profit

Deconstructing key indicators, delving into on-chain activity, institutional psychology, and the macroeconomic backdrop.

2025-12-31 15:11

Safety

stable currency

invest

technology

Odaily Editorial Team Tea Talk (December 31st)

Happy New Year, and see you on the battlefield next year!

2025-12-31 15:08

exchange

invest

AI

Prediction Market