Five Charts to Understand: Where Did the Market Go After Each Regulatory Storm?

- Core View: China's regulatory tightening continues, but the crypto market has become globalized.

- Key Elements:

- Seven major associations flagged risks related to stablecoins, RWA, etc., by the end of 2025.

- Historical regulations (e.g., 2017, 2021) did not alter BTC's long-term trend.

- The current market is primarily driven by global capital, such as Wall Street ETFs.

- Market Impact: Short-term sentiment is under pressure, accelerating the outflow of capital and projects.

- Timeliness Note: Short-term impact.

Original Authors: Viee, Amelia, Denise, Biteye Content Team

Recently, seven major financial associations in mainland China issued a new risk warning, specifically naming various virtual assets such as stablecoins, RWA, and shitcoins. While Bitcoin has not shown significant abnormal movements so far, the recent cooling market sentiment, shrinking account balances, and the off-market discount on USDT are reminiscent of scenes from past rounds of policy tightening.

From 2013 to the present, mainland China's regulation of the crypto space has spanned twelve years. Policies have been enacted time and again, and the market has responded each time. This article aims to trace the timeline, review market reactions at these key junctures, and also clarify one question: after regulatory implementation, does the crypto market head towards silence, or does it gather strength for a new start?

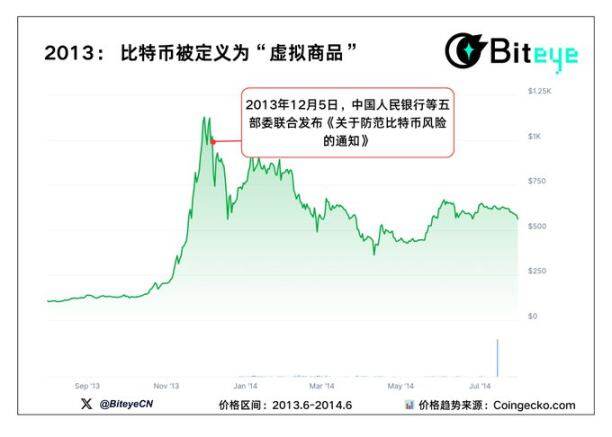

2013: Bitcoin Defined as a "Virtual Commodity"

On December 5, 2013, five ministries including the People's Bank of China jointly issued the "Notice on Preventing Bitcoin Risks," which for the first time clearly defined Bitcoin's nature as a "specific virtual commodity," stating it lacks legal tender status and is not a currency. Simultaneously, banks and payment institutions were prohibited from providing services for Bitcoin transactions.

The timing of this notice was also subtle, coming right after Bitcoin had just hit a then all-time high of around $1,130 in late November. In early December, Bitcoin's price was still fluctuating between $900 and $1,000, but a few days after the policy took effect, the market began to cool rapidly. Throughout December, Bitcoin's closing price fell to around $755, a monthly drop of nearly 30%.

In the following months, Bitcoin entered a prolonged downward consolidation phase, with prices mostly ranging between $400 and $600. This decline from the high essentially marked the end of the 2013 bull market. Subsequently, Bitcoin's price remained below $400 until the end of 2015.

The first round of regulation extinguished the early fervent flames and also opened the prelude to the game between "policy and market."

2017: ICO Ban and the "Great Migration" of Exchanges

2017 was a year of extreme frenzy in the crypto market and also the year with the most decisive regulatory action. On September 4, seven ministries issued the "Announcement on Preventing Risks from Token Issuance Financing," which characterized ICOs as illegal fundraising and demanded the complete shutdown of domestic exchanges. Bitcoin closed around $4,300 that day. However, within a week of the policy announcement, BTC briefly fell to a low of $3,000.

Although this round of regulation severed the dominance of mainland exchanges in the short term, it failed to shake the foundation of the global bull market. As trading activities rapidly migrated to places like Singapore, Japan, and South Korea, Bitcoin accelerated its rebound after a phase of liquidation, starting a continuous upward trend in October. By December 2017, three months later, Bitcoin's closing price had skyrocketed to $19,665.

The second round of regulation brought short-term seismic shocks but also invisibly propelled global diffusion.

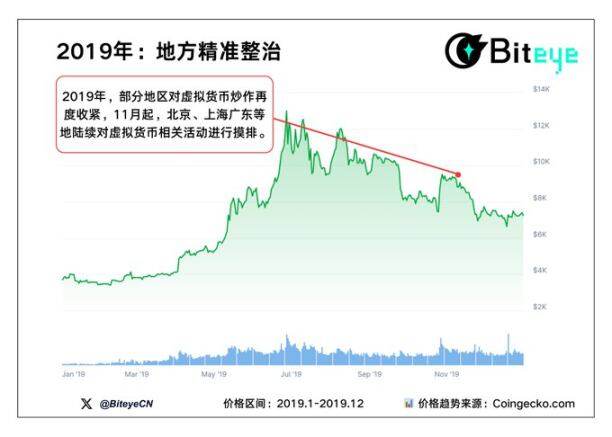

2019: Targeted Local Crackdowns

Starting in November 2019, Beijing, Shanghai, Guangdong, and other regions successively conducted investigations into virtual currency-related activities. The regulatory approach shifted to "targeted local crackdowns," with no relaxation in intensity. That month, Bitcoin fell from over $9,000 at the beginning to around $7,700, and market sentiment was once depressed.

The real trend reversal occurred in the following year. In 2020, driven by both the halving anticipation and global liquidity easing, Bitcoin initiated a bull market warm-up, rising from $7,000 to over $20,000, smoothly connecting to the epic bull market of 2020–2021.

In a sense, the third round of regulation cleared the path for the next phase of upward movement.

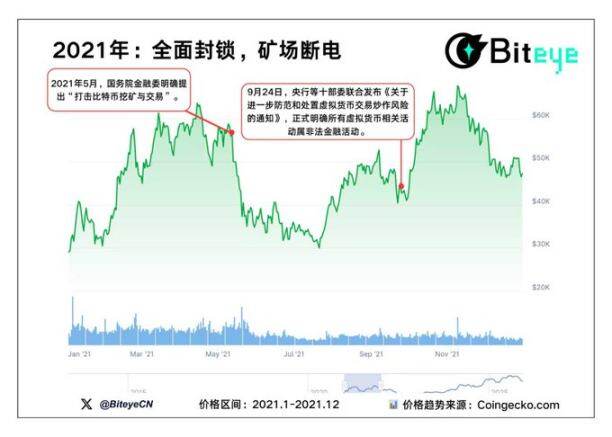

2021: Comprehensive Blockade, Mining Farms Power Down

In 2021, regulatory intensity reached its peak. Two landmark events this year completely reshaped the structure of the global crypto market. In mid-May, the Financial Stability and Development Committee of the State Council explicitly called for "cracking down on Bitcoin mining and trading." Subsequently, major mining provinces like Inner Mongolia, Xinjiang, and Sichuan successively issued policies for clearing out mining operations, triggering a nationwide "mining rig power-down wave." On September 24, ten ministries including the central bank jointly issued the "Notice on Further Preventing and Disposing of Risks from Virtual Currency Trading Speculation," formally clarifying that all virtual currency-related activities constitute illegal financial activities.

In May, Bitcoin fell from $50,000 to $35,000. Entering June–July, BTC consolidated sideways in the $30,000–$40,000 range, with market sentiment hitting rock bottom. Subsequently, Bitcoin bottomed out and rebounded in August, continuing its upward trend driven by optimistic expectations for global liquidity, ultimately reaching a new all-time high near $68,000 in November.

The fourth round of regulation showed that policies can delineate boundaries, but they cannot stop the global redistribution of hash power and capital.

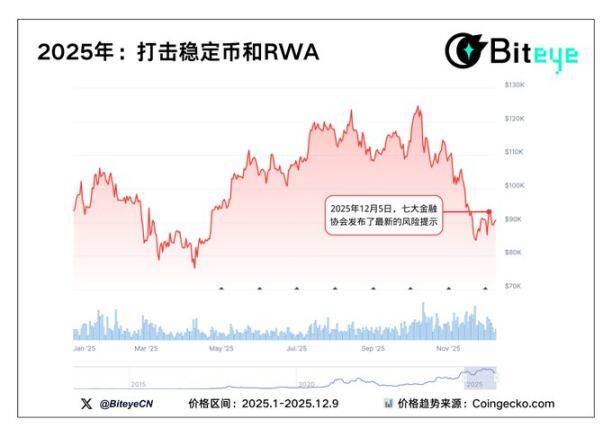

2025: The Reversal of Expectations – From "Innovation Probing" to "Comprehensive Tightening"

The regulatory narrative of 2025 is full of dramatic twists. In the first half of the year, a series of signals made the market sense a "thawing of the ice," with a cautiously optimistic sentiment spreading within the circle: from discussions in Hong Kong about stablecoin issuance frameworks to the on-chain tracking of "Malu grapes" in Shanghai's suburbs, the market began discussing the possibilities of "compliance paths" and the "Chinese model."

The wind direction changed abruptly at the end of the year. On December 5, the joint risk warning issued by seven major financial associations conveyed a clear core message:

- Clearly stating that virtual currencies are not legal tender

- Specifically naming hot concepts like shitcoins, stablecoins, and RWA for crackdown

- Not only prohibiting domestic trading but also banning promotional引流 activities, indicating more detailed regulation

The core upgrade of this risk warning lies in: It not only reiterates the illegality of virtual currency trading but also extends for the first time to the currently hottest niche sectors (stablecoins, RWA) and promotional behaviors.

So, how will the market move this time? Unlike before, Chinese capital is no longer the market's dominant force; Wall Street ETFs and institutional holdings have become the new main drivers. What can be observed is that USDT is trading at a negative premium, indicating many are rushing to convert back to fiat and exit.

Market Voices: KOL Perspectives Summarized

Well-known media personality Wu Shuo @colinwu, from an execution perspective, reminds everyone to pay attention to the movements of CEXs. The real wind direction depends on whether platforms restrict domestic IPs, KYC registrations, and C2C functionalities.

XHunt founder @defiteddy2020 compares mainland China and Hong Kong, believing the stark contrast in crypto policies reflects different market positioning and regulatory philosophies.

Solv Protocol co-founder @myanTokenGeek believes this round of regulation may lead to two consequences: first, accelerated overseas migration of users and projects; second, a resurgence of underground gray channels.

Shanghai Mankun Law Firm founder Lawyer Liu Honglin @Honglin_lawyer adds from a legal perspective that many RWA-type projects are indeed non-compliant; those raising funds and pumping prices under the guise of compliance are essentially no different from scams. For teams genuinely building, going overseas is the only solution.

Crypto OG @Bitwux believes this is just official confirmation of what the industry already knew, with limited impact. The regulation is more about reiterating old points, with the focus likely on preventing the spillover of gray area channels.

Independent trader @xtony1314 states that this time it's led by public security, not just talk anymore. If subsequent law enforcement actions and restrictions on trading platforms follow, it could trigger a round of "active flight + market stampede."

Independent trader @Meta8Mate believes that whenever a concept overheats, a risk warning follows. It was ICOs in 2017, mining in 2021, and now it's stablecoins and RWA's turn.

Conclusion: Storms Have Never Stopped the Tide's Direction, They Only Change the Course of Navigation

Looking back over these twelve years, we can clearly see a continuously evolving and goal-oriented logical thread:

Regulatory policies have remained consistent and are necessary and reasonable. A grain of sand from the era can be a mountain on an individual. The impact of regulatory policies on the industry goes without saying, but we must admit: regulation aims to protect investors from uncontrollable financial risks and maintain the stability of the local financial system.

Regulatory actions exhibit distinct "timing selectivity." Policies often land when market heat reaches a peak or local top, aiming to cool down overheated risks. This has been the case from the tail end of the 2013 bull market, the 2017 ICO frenzy, the peak of mining in 2021, to the current heating up of stablecoin and RWA concept speculation.

The long-term effectiveness of policies is diminishing. Except for the first round of regulation in 2013, which directly ended that bull market cycle, subsequent powerful interventions (the 2017 exchange shutdowns, the 2021 mining crackdown) have not altered Bitcoin's long-term upward trend.

Bitcoin has become a "global game." Wall Street ETFs, Middle Eastern sovereign funds, European institutional custody, and even the consensus of global retail investors together constitute the main support for the current price.

A core conclusion is: The dualistic structure of "strict prevention and control in the East" and "pricing dominance in the West" may become the new normal for the crypto world.